How to check medical insurance status with Emirates ID. This is a very common question for people who have medical emergencies in the UAE. If you need to visit a hospital urgently, but can’t find your health insurance card, there is no reason to worry. In the United Arab Emirates, you have the option of presenting your Emirates ID at a hospital or clinic as a substitute. Your unified number or Emirates ID also provides the option to check your health insurance status. That is, you can find out what your health insurance coverage network and benefits are.

In this article, you will learn how to check medical insurance status with Emirates ID. Since 2017, health insurance providers have linked their policies to customers’ Emirates IDs. As a result, clinics and hospitals are required to verify a patient’s health insurance status and provide the necessary coverage benefits. The UAE government has digitized all health services. Therefore, the Emirates ID application process now includes the need to have valid health insurance.

Check The Health Insurance Provider’s Website or Download Their App

In the UAE, all health insurance providers are well-trained to check your health insurance status using your Emirates ID through a secure online platform. In this way, the online platform matches the number with the member’s profile that is in Daman’s database.

Additionally, these checks can be done using the member’s card number. For this reason, simply visit the website of the Federal and Citizen Authority. Then, locate the portal to get your Emirates ID details. In this way, enter your Emirates ID number in the column that has been assigned.

Now you just need to click submit to check all the available details of your Emirates ID. Currently, many health insurance providers in the UAE offer online portals or mobile applications. This way, they can access their insurance information only using their Emirates ID.

For this reason, it is important that you check the status of your Emirates ID to avoid any inconvenience in this process. This way, when you are looking for the best medical insurance in UAE you will have no problems consulting on their website or app.

Phone Their Insurance Provider’s Customer Support Hotline

If you want to contact the customer service of your insurance provider in the UAE; You can do it through their telephone service line. Most health insurance companies in the UAE have customer service lines. In addition, these lines are available 24 hours a day and 7 days a week.

For this reason, if you need to know about medical insurance for parents in UAE, medical insurance for born babies in UAE, etc., these lines are designed to help you. In this section, we will teach you how to contact customer service in the UAE.

First step: Contact your insurance provider for assistance verifying your health insurance status.

Second step: You must provide your Emirates ID number to the representative of your insurance provider.

Third step: After the insurance provider representative verifies your identity, they will provide you with updated insurance information.

These steps are general and may change depending on your insurance provider. Additionally, it is recommended that you contact your insurance provider directly; This way you can obtain specific instructions to verify the status of your insurance over the phone.

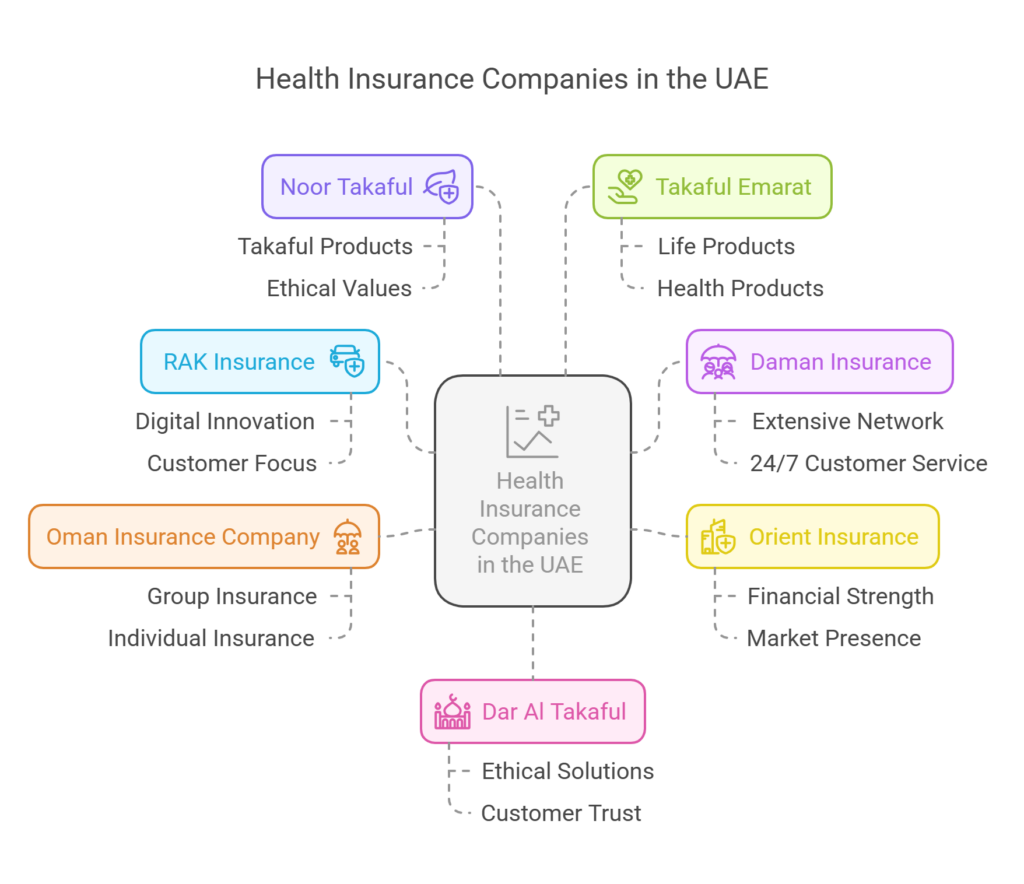

List of Insurance Companies that Offer Health Care Services with the Emirates ID Card

You can find many companies that offer health insurance in the UAE. From medical insurance in Dubai to medical insurance in Sharjah. For this reason, we will present you with 7 of the top 10 medical insurance companies in UAE. This way, you will be able to see the range of services they offer and they all accept the Emirates ID as a form of identification and coverage for health insurance.

RAK Insurance

Ras Al Khaimah National Insurance Company has grown significantly since its inception in 1974. Its vision is to offer simply better insurance solutions to all customers in the UAE. Furthermore, they aspire to be the leading insurer, focused on their customers in the UAE.

It offers convenient access to insurance products that are innovative and competitive across multiple channels to businesses and individuals. Being one of the longest-established insurers in the country, RAK Insurance strives to continuously provide and develop insurance products and services in the UAE.

Additionally, they believe that the adoption of digital and technological innovation improves operational effectiveness and customer experience. They have even invested a lot in the continuous development of their mobile application and online portal. In this way, they give you easy access to their set of services and products.

Daman Insurance

Daman Insurance Company is the leader in the UAE offering more than 2.8 million people comprehensive solutions. Additionally, it is part of PureHealth, the largest integrated healthcare platform in the UAE. This platform has an ecosystem that defies life expectancy.

Count commas from 28 hospitals, 100+ clinics, insurance solutions, multiple diagnostic centers, etc. In this way, it has become a pioneer in healthcare insurance. Driving innovation by combining cutting-edge technology and healthcare expertise.

Furthermore, Daman offers you a customer service center that is available 24/7. Having a medical services authorization team that is in direct contact with the Daman network. Also, the company offers you a wide range of digital services that are unmatched in the UAE.

Orient Insurance

Orient Insurance Company has been in the UAE market since 1982 and is part of the renowned Al-Futtaim group. Since this moment the company has shown progressive and constant growth. This company is one of the leaders in the country’s insurance market. Additionally, they have a paid-up capital of AED 500 million. That is, the highest in the insurance industry in the UAE.

Their main headquarters are in Dubai, but they serve their clients from an extensive network of branches in different cities. For instance, Abu Dhabi, Ras Al Khaimah, Sharjah, Al Ain, and Jebel Ali, within the UAE. They are also found in Oman and Bahrain.

Among the main strengths of Orient Insurance Company is its solid financial foundation. In addition, it has a highly qualified and customer-friendly workforce and a deep knowledge of the local insurance market. Finally, they provide a diversified product range complemented by a strong panel of top-tier European reinsurers.

The wide range of products that this company offers are:

- Commercial line insurance

- Personal line insurance.

There is a range of products in general that includes types of insurance. These include fire, motor vehicle, all property risks, business interruption, cargo, and many more. Other interesting insurance services are goods in transit, maritime hull, happiness guarantee, theft, and workers’ compensation. In addition to providing all-risk insurance for travel, home, all-risk contractors, and all-risk assembly. They also provide medical insurance for visit visas and others.

It is important that you know that this company provides you with the option to review health insurance in various ways. This is why it is important to learn how to check medical insurance status with Emirates ID.

Oman Insurance Company

Oman Insurance Company, currently better known as Sukoon Insurance. This company offers a variety of health insurance options in the United Arab Emirates. Additionally, you can find insurance coverage in Oman for group and individual insurance. Oman health insurance is fully available in the UAE.

This is an insurer that has more than 45 years of experience. Furthermore, it is among the top health insurance providers in Dubai. Oman Insurance Company provides innovative online solutions that ensure filing complaints is fast and efficient. That is why clients have to learn how to check medical insurance status with Emirates ID.

Oman Insurance Company’s mission is to place customer satisfaction in everything it does. That is, clients can have complete confidence in hiring this insurance company.

The high quality of group health insurance in Dubai is not the only quality that this company has. They also provide a variety of individual insurance for all clients. Oman Insurance Company is a participating insurer of the DHA plan and provides a range of coverage solutions. They cover all types of plans from basic health insurance coverage to comprehensive plans.

This insurer also provides auto insurance. Customers can find a range of products from the insurer to eliminate stress. This way, consumers can find the ideal coverage for their different needs.

You have to know that Oman Insurance has currently been the winner of many accolades. In addition, they have many positive comments from customers. In 2020 they won the General Insurer of the Year award at the MENAIR 2020 awards.

Noor Takaful

The Noor Takafil Insurance Company contains two sister companies. The first is the Noor Takaful Family. The second is Noor Takaful General, both subsidiaries offer a wide range of insurance services. Noor Takaful began offering services in 2009. Since then it has shown significant growth to become an important supplier in the UAE market.

Noor Takaful has shown its commitment to being at the forefront of the Takaful sector in the Middle East. Your contemporary vision of Islamic insurance. As a result, they can offer several innovative products and services to their customers. For instance, Motor Takaful, Medical Takaful, Commercial Takaful, Personal Takaful and Travel Takaful. Additionally, the insurer offers online and instant quotes, each with payment facilities. It is important that you learn how to check medical insurance status with Emirates ID.

Since entering the UAE market, they have achieved an impressive process in consolidating their reach. Furthermore, they successfully established the Noor Takaful brand. This is by creating a solid foundation and platform for the future growth of the company. Over time they have been winners of industry-leading awards.

The Noor Takaful brand aims to provide the best quality of protection through systems with interesting features. That is modern flexibles and state-of-the-art channels. The Noor Takaful insurance team’s mission is to offer different insurance company solutions. That is, as innovative and ethical as possible.

They have some fundamental values, which are ethics, quality, agility, empathy, and passion. Furthermore, they are always at the forefront of all their operations.

Takaful Emarat

Takaful Emarat Insurance entered the UAE market in 2008. This is a leading health and life Takaful provider in the country. Takaful Emarat markets a wide range of corporate and individual Takaful life and health products. Among them, are savings, protection, and investment plans through a variety of distribution channels.

Takaful Emarat’s vision is to be an international leader in the CCF, North Africa, Middle East, and Islamic countries. Furthermore, the mission of this insurer is to manage the financial security of participants with full compliance in Sharjah. Not only that but also gain consumer trust by providing value-added services and products backed by international experience. Finally, act transparently and fairly in the best interests of participants.

Takaful Emarat also has some interesting objectives, which are the following:

- Promote the ideology of Takaful as a genuine alternative to sharia-compliant insurance.

- Promote and design Takaful products based on modern approaches and emerging needs.

- Obtain the best financial results for shareholders and participants.

- Expand Takaful Emarat Company globally and regionally.

Dar Al Takaful

Dar Al Takaful enters the market in 2008 with a paid-up capital of AED 100 million. That is, like an Islamic insurance company that has its main headquarters in Dubai. Furthermore, it offers Sharia-compliant solutions to meet the insurance needs of its clients.

Dar Al Takaful is a professional, innovative, and principled local insurance company. Managerial decision-making is very close to capturing customers’ insurance wants and needs. Furthermore, in order to meet all the expectations and insurance needs of consumers, they are resolved with tailor-made ethical solutions.

Its commitment to clients is supported by a solid group of investors. Each of them provides the support and strong financial foundation that allows them to feel secure. Of course, no matter what your line of business is.